After the Punjab “farmer” protests began, the average newspaper reading Indian, who probably had not even heard of the acronym “MSP” slowly learned what MSP is: a subsidy (since it is much higher than market price) offered by the Government of India to farmers growing any of 24 crops, but substantially mostly spend on the farmers of Punjab growing wheat and paddy. It had its roots in food-shortage era India of the 60’s and was meant to incentivize the production of basic food grains. In food-surplus era India of today, it is a liability: a huge cost that the government incurs to procure foodgrains from farmers who now have become entitled and think it is their right to sell their produce to the government at a good price, even when there is insufficient demand for this produce. Result: the FCI spends a lot of money procuring these grains, and build up huge surplus stocks (of 2+ years worth of demand) which are economically non-sensical and ruinous.

By now, the average newspaper reading Indian has figured out this big subsidy that goes to Punjab.

In this article, we will discuss a far less known “subsidy.” Recall that India has moved to a GST taxation regime. This blanket taxation is supposed to revolutionize our tax structures, increase government revenues, and make it easier to comply with tax codes. Initially viewed with skepticism by many (especially on the left), GST has come along rather nicely. Just recently, the government released its latest figures: for the first time, in the month of December 2020, GST revenue has exceeded Rs. 1.15 Lakh Crore in a single month. Good news indeed for anyone who wishes well for our country.

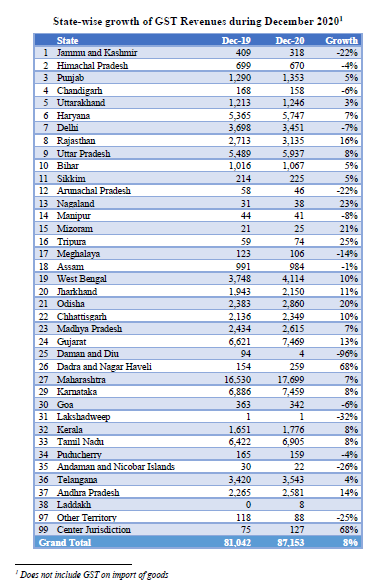

Let us drill into the details though. Here is the statewise breakup of GST collection. Source is most recent GoI statement on GST.

The data shows the increase of GST revenues, by state, over the past year, for the month of December. The increases are impressive and consistent. Now, let’s look at the states contributing the most to GST. Industrial powerhouse Maharashtra leads by a long distance, with 17K crores. Gujarat, Karnataka, Tamil Nadu are the follow-up pack, with over 6K crores each. Next come the states of Haryana (important, as I will point to shortly) etc. with almost 6K crores. Then Delhi, and so on.

Where is Punjab? Did I miss it? No. Punjab’s GST contribution is a measly Rs 1353 crores. It is less than a tenth of Maharashtra! It is less than a quarter of the likes of Gujarat, Karnataka, and Tamil Nadu. And, coming back to the state that is most “like” Punjab—Haryana, it is about a quarter of Haryana’s collection! This is indeed very puzzling, and disappointing. Why is this state not contribution to GST collection. Could it be that this is because the data I have shown is only for December? No, one can check that the trend remains similar for full annual data as well.

So what gives? It is not the scope of this article to investigate fully the reasons for this abysmal GST contribution of a state whose farmers frequently make chauvinistic statements about “feeding the country” etc. (when in fact Punjab only produces about 13% of India’s wheat, less than Uttar Pradesh’s 18%). We merely want to point out that there is a severe discrepancy here too that goes in favor of Punjab. Another big sop that other states do not enjoy. One reason is that agri-implements are exempt from GST (no prizes for guessing which lobby this was intended to appease). But that itself does not explain why Haryana is able to raise so much more GST revenue than Punjab.

Recently, the Punjab government declared that it was about 45% short of its GST target. It cited covid as the reason. On this, firstly covid is not a problem specific to Punjab, so this in itself does not explain why Punjab is so far behind in GST collection. Secondly, even if this 45% were accounted for, Punjab still falls far short of what might be expected from one of India’s richest states as far as GST contribution.

There is an increasing awareness among India’s thinking population that Punjab is getting too sweet a deal: selling nearly all its produce to the GoI at high MSP, freebies such as free electricity, freedom from penalty for stubble burning that makes Delhi into a gas chamber. These are known. We hope that with this article, another major imbalance that favors this one state will also be inserted into this national discussion. It is clear to anyone who wishes well for the country that Punjab must play on a level playing field with other states in the new economic system we are trying to progress into. The days of subsidies and freebies, often maintained for political purposes, are going away. It is time we had a serious discussion on why Punjab is always accorded special treatment.

As but one example: Maharashtra contributes the most to GST, and YET has the most farmer suicides because its farmers are not being subsidized massively at national cost the way Punjab’s farmers are. And that is simply not fair, and it must end.