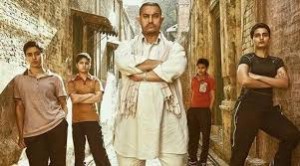

It’s that time of the year when Aamir Khan comes with his unique offering at the box office and set it ablaze with collections running in several hundred crores. This Christmas is no different. Much awaited film of the year for both Aamir Khan fans as well as true Bollywood buffs ‘Dangal’ hit the screens on Friday. The buzz movie had generated months before the release was astonishing, if YouTube views of the trailer was anything to go by.

Before I start elaborating on this subject, let me put the disclaimer upfront. I admire acting prowess of Aamir Khan, but would not watch Dangal in the theatre, simply because of certain views of the actor didn’t go down well with me.

Whether it was with respect to him subtly taking dig at Hinduism under the guise of addressing social issues in Satyamev Jayate and PK or his comments on intolerance. Anyone who has seen the entire interview of Aamir Khan on intolerance remark, would agree that he was not provoked into saying what he said, rather his response seemed premeditated and completely agenda driven.

Actor’s dislike for PM Shri Narendra Modi is obvious, in the past he directly accused him of killing people in Gujarat as the CM, Aamir Khan was amongst the ones who had signed petition to US to keep denying him visa. The actor was also amongst the signatories of petition, group of filmmakers had put up to influence people for voting anyone but Narendra Modi.

Aamir Khan calls himself a thinking man’s actor and therefore it’s all the more obnoxious of him to get swayed so easily by a political propaganda and make ungrateful comments about the public at large.

Dangal declared Tax free in UP,Uttarakhand and Haryana, Why?

Notwithstanding my personal views, I’m quite certain that Dangal would be a smash hit at the box office. Aamir Khan is an extremely talented actor and it would be too difficult to not appreciate his performance on the silver screen. Contrary to Aamir’s views a year ago, general public is ‘tolerant’ enough to not let few unappreciative statements cloud their judgement.

What’s not adding up is the decision of some state governments to make Dangal tax free. It befuddles me because entertainment is neither fundamental right nor it aids upward mobility of the poor people. So what made the government of Haryana, UP and Uttarakhand forego the entertainment?

Entertainment tax accounts between 15-50% of the ticket cost depending upon the states. Waiving off the entertainment tax doesn’t necessarily mean that ticket prices would go down. It is incumbent upon the exhibitors to pass on the benefit to the viewers , however there is no law to force exhibitors to pass on the benefit or to take them to task for not doing so. Experience suggests that the movie prices do go down only gradually and not immediately, after it’s made tax free.

The proponents of Tax free movies, cite the reason of increasing movie’s reach to back their argument. It’s certain that once the price goes down market access automatically improves. However, why should the government subsidize it in a developing country. It’s still fair for the government to subsidize items needed for sustenance like food; fuel, as well as essentials for growth, well being and development like health and education. Where entertainment fits into the above mix to warrant a subsidy is beyond me.

Not only Aamir Khan, but several other actors and filmmakers have lobbied hard with the governments from time to time to get their movies declared tax free. Actors would obviously benefit due to greater visibility and distributors would get higher profitability, whereas filmmakers would be encouraged to make more such movies again owing to higher returns.

With some notable distributors like Eros getting listed and some global distributors like MGM , FOX coming into the scene, the activity after the movie is produced is still to some extent transparent. But activities that go into the making the film right from the financing, to the payment rolled out to artists is still predominantly opaque. There are tell-tale signs of underworld money still flowing into Bollywood and the industry is still considered as a syndicate for money laundering.

How does movie economics work?

Before we get into who benefits due to tax free, it’s important to ascertain the economics involved on the basis of available information. Below illustration (figures in rupees) will help:

a) Movie cost =50 cr

b) Movie sold to Distributor @ 75cr (at profit share 50:50)

c) Promotion cost = 25cr, Cost to distributor 100 cr

d) Collections =300cr in India (For all 3 khans, Hritik it’s not a far fetched number to assume)

Less Entertainment Taxes @ 20 % = 60 cr, Less Margin of Exhibitors @ 20% =60 cr , Less promotion cost =25cr

e) Profit for distributor =155 cr

f) Profit to be shared with filmmaker = (155/2) = 77.5 Cr (Note -75cr is already paid- refer (b))

At the end of the day,

Distributor gets to keep = 155-2.5 = 152.5crs (profit 77.5cr), Filmmaker earns =77.5cr (Profit 27.5cr)

(Note – We haven’t included the collections overseas which will be atleast 50% over and above, also most of the top distributors are vertically integrated. Entertainment Tax rates are 20% in MP, Gujarat Delhi, 30-40% in UP, 45% in Maharashtra and 50% in Bihar)

So who actually benefits from the Tax waiver?

Beneficiaries would include viewers because they have to pay less for the tickets, distributors, producers and actors (who double up as producers or even distributors) who’ll get higher revenues because of increased footfalls and also higher profitability.

Whereas, the government would stand to lose. As we saw in the example above 20% entertainment tax means a whopping 60 crs- that’s the amount of money government foregoes at the benefit of distributors and filmmakers who are already multi-millionaires; isn’t this a form of crony capitalism?

Moreover, for the state governments it has become another way of scoring brownie points, like UP and Bihar declared PK tax free to appease some sections.

I am all for encouraging meaningful cinema and promoting movies with a social message. But isn’t it the responsibility of filmmakers to part with a fraction of their profits and ensure that movie tickets are lower, after all they claim it’s for the larger good.

By deciding not to forego the entertainment tax, government will also make filmmakers to think at other ways and means of bringing down their expenditures, like turning to not so established theatre

PS- Any revenue foregone or the expenditure made by the government has a direct impact on its ledger, but to take losses for entertainment with no major tangible benefit to the people, but as a consequence shoring up the profitability of multi-millionaire filmmakers is completely wasteful.