This is an article that I wrote in my blog a few days before the February 2020 Delhi elections. In this article, I bust the myth about Delhi’s tax revenue collections made by CM Kejriwal during the election campaign. As this article has tables with numbers in them, it is best read over a PC instead of a mobile phone.

A friend of mine who is a supporter of AAP based on their “work” in Delhi, shared this with me recently – “People of Delhi realised that good people are now in the government and hence they paid more taxes than before. So, Delhi’s tax collection increased from Rs. 30,000 crores in 2014-15 to Rs. 60,000 crores in 2019-20”.

Being a Financial analyst, he made zero efforts to look into the numbers before accepting them. On other matters we may not be qualified to speak about, but examination of financials is our job. That is what he has studied and practised for the last eight years. While the doubling of revenue is a possibility, I really thought he was joking when he said, ‘people paid more tax on their own’. Sadly, he was not, an indictment on his last eight years of education.

I write this article after having gone through several of Delhi’s and other states’ budgets. And before writing about the budgets I would like to add here how easy it is to access Delhi’s budget in comparison with a lot of other states. Maharashtra could not have made it more difficult and I had to solely rely on private organisations to analyse Maharashtra’s budget.

Anyway, I could end this entire article in just two lines ie.:

1. Exponential increase in tax base under GST.

2. Consumption based tax regime and population explosion

But since some may not be familiar with taxation system, let us get into the details:

There are several aspects to the tall claim. Let us examine them:

A. Start at Rs. 30000 crores

B. End at Rs. 60000 crores

C. People paid more tax out of trust

*Links to Delhi’s government website from where the following tables are drawn are provided at the end of this article*

Let us look at A.)

From Table a1 we gather that my friend is talking about the tax collections which stands near their claim of Rs.30000 crores. Let us bear in mind that he is not talking about Total receipts of the Government.

| Total receipts (sum of all) | Opening Balance | Tax | Non Tax (interest, penalties etc.) | Others (recvd. From GOI, etc.) | GST Compensation | |

| 2014-15 | 37103 | 0 | 31571 | 1161 | 4371 | 0 |

Now, what are the components of ‘Tax’? Table a2:

| Tax (sum of all) | VAT | Excise | Other (Luxry, entertain, betting) | Tax on MV, Stamp & Registration | |

| 2014-15 | 31571 | 21000 | 3600 | 571 | 6400 |

You will find that Tax is made up of VAT, Excise Duty, Luxury Tax, Entertainment Tax, Tax on betting, Tax on Motor Vehicles, stamp duty and registrations etc.

Now, let us move on to B.) End at Rs. 60000 crores

From Table b1 it is evident that now he is talking about total receipts and no longer about just Tax.

| Total receipts | Opening Balance | Tax | Non Tax (interest, penalties etc.) | Others (recvd. From GOI, etc.) | GST Compensation | |

| 2014-15 | 37103 | 0 | 31571 | 1161 | 4371 | |

| 2019-20 | 60000 | 4447 | 42500 | 800 | 9253 | 3000 |

Alright, so before we examine the components of Total receipts, let me for the sake matching, provide you with the components of Tax in 2019-20 in Table b2

| GST | |||||

| Tax | VAT | Excise | Other (Luxry, entertain, betting) | Tax on MV, Stamp & Registration | |

| 2014-15 | 31571 | 21000 | 3600 | 571 | 6400 |

| 2019-20 | 42500 | 29000 | 6000 | 0 | 7500 |

Let us examine the components of Total receipts from Table b1

Opening Balance: Unused receipts from previous years

Tax: Discussed in Table b2

Non-Tax: Includes interest on late filing of tax returns, penalties etc. but since it is only Rs. 800-crores, no point discussing it further

Others: This is a major component with Rs. 9,253 crores and hence requires some explanation-Components include:

1. Small saving loan: 4,786 crores (Website under maintenance)

2. Centrally sponsored scheme: 2,558 crores

3. Capital Receipts: 750 crores 4. Normal central assistance: 472 crores

5. Share in central Taxes: 325 crores

6. Externally Aided Projects: 300 crores

Small savings loan (1), Capital receipts (3) and Externally Aided Projects (6) are all various forms of loans. (1) being the biggest component, I wanted to understand the exact money flow there, however the website of SSL is currently under maintenance and hence could not be accessed.

The other components (2) and (4) are money inflow from central government under various Central government schemes. (5) is Delhi’s share in central taxes: The shareable central taxes include corporation tax, income tax, wealth tax and customs. Since it is only Rs. 325 crores, a deeper look is not necessary.

Anyhow, we can conclude that “others of Rs. 9253 crores” is mainly Central government assistance and loans taken by Delhi Government.

GST compensation: Finally, we come to the last and the most important component of Delhi’s Total revenue and that is GST compensation of Rs. 3,000 crores.

What is GST compensation? Government of India while introducing GST, computed an all India average growth of 14% in tax revenues year on year with base year ending on 31 March 2016. It assured the state governments like Delhi, that their tax revenue will at least increase by 14% and any shortfall will be Bourne by Central government for the next five years starting from Financial year 2017-18 (As GST was introduced in July 2017).

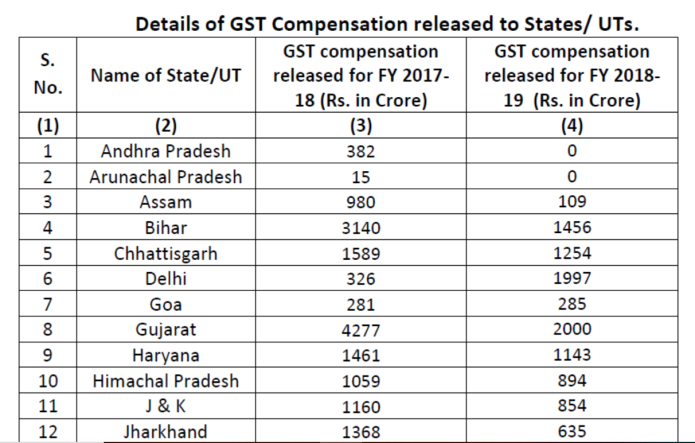

Every state faced some difficulty in the first year of introduction of GST. However, most states picked up well and slowly reduced their compensation. Image j1 is a screenshot of the compensation awarded in 2017-18 compared with 2018-19

From all the 31 states under the GST Act, Delhi and Goa are the only two states in 18-19 whose compensation has grown compared to 17-18. Goa a mere 1.4% increase whereas Delhi’s compensation grew by a staggering 512%. Sadly, in 2019-20 this has again grown to Rs. 3,000 crores.

This is an eye-opener about the myth of ‘people paying more tax on their own’.

I had decided that I shall not make this article political and shall keep it about Delhi’s budget only, [Don’t ask me for links of videos to prove what’s in this paragraph, its anyway not the subject of this article, find it yourself] but:

This myth comes from genius mind of Mr. Prashant Kishor. He has made the entire election campaign of AAP as “people of Delhi vs. outsiders”. When you watch the recent interviews of AAP supremo you will find him sharing the insults he received from Congress and BJP with the people of Delhi ie. If BJP/Congress calls AAP a corrupt party, you will find AAP communicating that to Delhi’s people as, “They are calling Delhi’s people corrupt”. And similarly, there’s a feel-good factor about knowing ‘my city people have given more taxes on their own’. Hats off to the strategist.

Let us now conclude with C.) People paid more tax out of trust

Before I move further let us discuss some important aspects of GST:

1. Increase of tax base in GST in comparison with past tax systems – Under GST Act even those transactions which were not under the purview of previous taxes, have now been added and thus more people are to pay GST. More than Five Lakh new registrations happened in a single year in Maharashtra because of change in tax systems.

2. GST is a consumption/Destination based tax system – Any item that is produced in Karnataka but if consumed in Delhi, the tax on that item majorly belongs to Delhi and a small share to Karnataka. Hence, ideally with a growing population the tax collection should increase. But a capable government ensures higher collections than just what is proportional to the population growth.

Thus, from image j1 and a brief understanding of GST, it is clear that the myth of people paying more tax on their own is nothing more than a lie. Sadly, Delhi is not even growing at 14% average year on year and that is why Central government is paying a compensation to Delhi.

Kejriwal is not an illiterate politician. Rather he is a former IRS officer and yet he made that statement. Which proves yet again that the so called “Satya Harishchandra” of Indian politics that his followers make him to be, he simple isn’t.

So, is Delhi’s economy in a bad shape?

This article is not about evaluating Delhi’s performance. This is merely a check about the tax collection claim.

Now, from table b1 we understand that the actual comparable figures are Rs. 31,571 crores in 2014-15 and Rs. 42,500 crores in 2019-20. Which is a growth of 34% in 5 years or an average growth of 6.8% per annum. These are the comparable Tax figures.

Comparisons of total receipts is not correct as it also includes loans.

As Delhi has a unique geo-political situation, comparing tax collection growth rates with other states and showing Delhi down or showing Delhi in a positive light, both would be wrong. Hence, I shall leave it at this.

Must Read: My letter to the Government of India

If you are from Delhi and if you are reading this article (unlikely, as I have no friends from Delhi) I hope you shed the garb of ‘I vote on development not on ideology’, and vote on truth.

I don’t know what the truth is, because I have not researched on all subjects, and neither do I intend on doing so. But in this age of social media influencers it is easy to cover the truth and call that as distinctive from ideology. Sadly, the moment you cover the truth – that too is an ‘ideology’.

References: (Click on the link)

1. Budget of 2014-15

2. Budget of 2019-20

3. GST compensation image: https://pqars.nic.in/qhindi/247/Au38.pdf

Some FAQs:

What if your friend is wrong? AAP never claimed that.

Ans.: Start from 6:09 https://www.youtube.com/watch?v=Jw-FoLDyO7U

A point to note here is that Kejriwal is a former IRS officer – that means he understands all the aspects of finances ie. revenue and tax, yet he made that statement – which goes on to prove that the so called “Satya Harishchandra” of Indian politics that his followers make him to be, he simple isn’t.